The types of discount rates commonly used in corporate finance include: What is the present value?Īn Excel example of a more complex PV computation can be seen below: It is known as the Net Present Value (NPV).Ĭonsider a future cash flow of $100, which is set to be received in four years. The present value can also be the sum of all future cash flows discounted back.

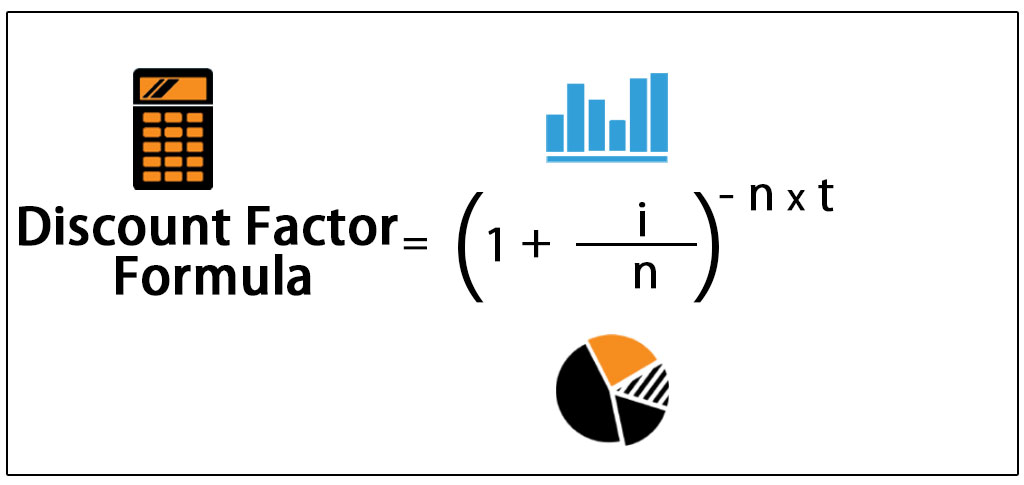

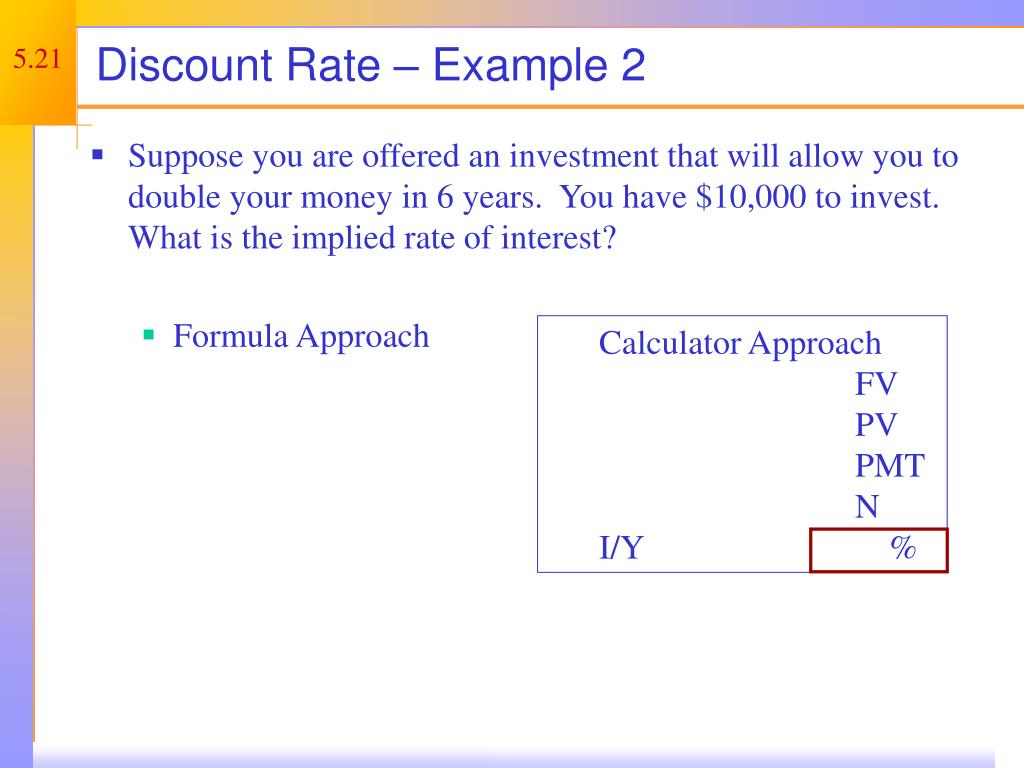

FV is used to denote the future value of cash flow.To derive a discounted value or the present value, the following equation can be used: The projected cash flows for start-ups that are seeking money can be discounted at any rate between 40% to 100%, early-stage start-ups can be discounted at any rate between 40% to 60%, late start-ups can be discounted at 30% to 50%, and mature company cash flows can be discounted at 10% to 25%. Founders tend to derive optimistic projections for their ventures, and due to their reduced marketability, there is a limited number of investors who are willing to take on the investments. Start-ups tend to be discounted at relatively higher rates to account for the risk associated with the investment and uncertainties on the guarantee of the future cash flows. Mature companies, for example, are likely to have lower discount rates than start-ups or early-stage businesses. An important element when estimating a suitable discount factor would be the stage at which the business venture is at, in terms of the business cycle. When discounting the cash flows of investments or business ventures, it is vital to note that the discount rates used will vary depending on various elements.

The hurdle rate is the return that investors anticipate concerning the risk associated with the investment they have made. In corporate finance, cash flows are normally discounted at a company’s weighted average cost of capital (WACC), its hurdle rate, or the required rate of return. Discount RateĪ discount rate (also referred to as the discount yield) is the rate used to discount future cash flows back to their present value. The future cash flows’ present value is obtained by using a discount rate or factor and applying it to the cash flows. It means that they can produce cash flows that allow the business owner or investor a return.Įxamples of such cash flows can be interest received from a bond or fixed-term deposit, or dividends received from a stock. When it comes to business ventures and investments, assets are considered to not carry value unless they come with cash flow generation potential.

#DISCOUNT RATE IT SERIES#

Discounting refers to the act of estimating the present value of a future payment or a series of cash flows that are to be received in the future.

0 kommentar(er)

0 kommentar(er)